Technology

What Is A Foundry? The Hidden Hero Of Semiconductor Manufacturing

The era of fabless semiconductor companies and behind-the-scenes foundries

A semiconductor company conventionally manufactures and sells semiconductor devices. However, many such companies own no fabrication plants and do not manufacture devices. These firms, focusing on product planning, development, design and marketing, are known as fabless semiconductor companies. So, who does the manufacturing? It's done by foundries—contract manufacturers of semiconductors that operate behind the scenes. Foundries produce devices under contract for fabless firms and never market products under their own brand, making them invisible to consumers. Nonetheless, they are the unsung heroes powering today's semiconductor manufacturing.

Currently, most foundries operate large fabs across East Asia, particularly in Taiwan. Because of this concentration, they have come under scrutiny amid rising geopolitical challenges involving the U.S., China and Taiwan.

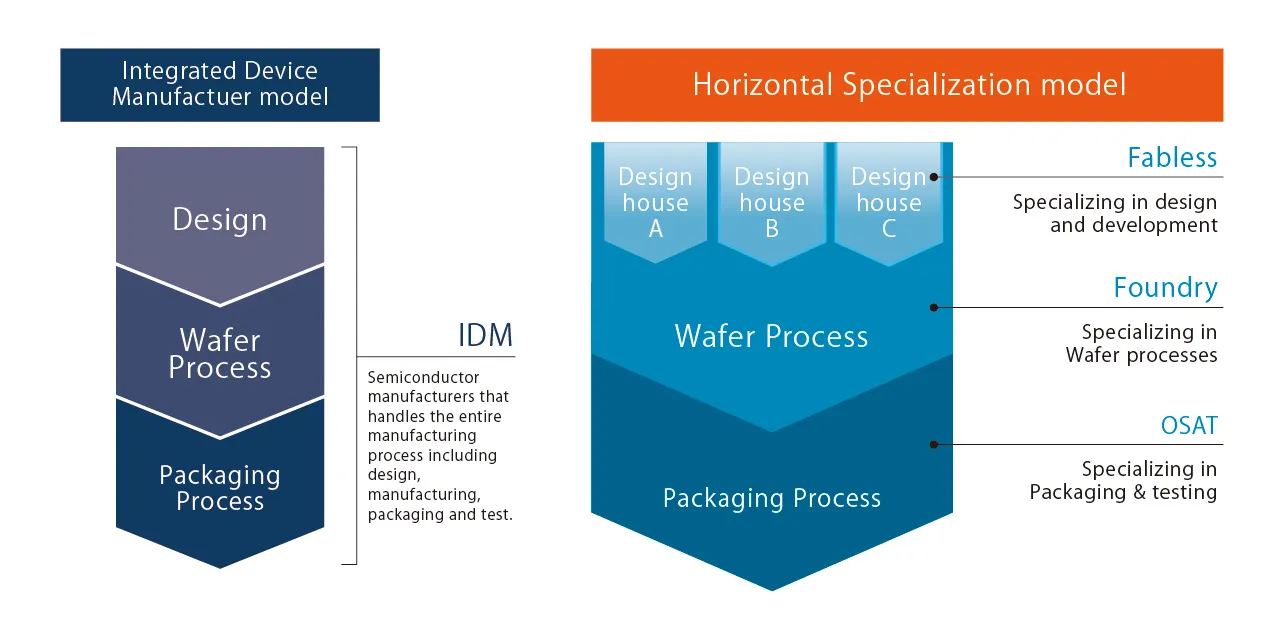

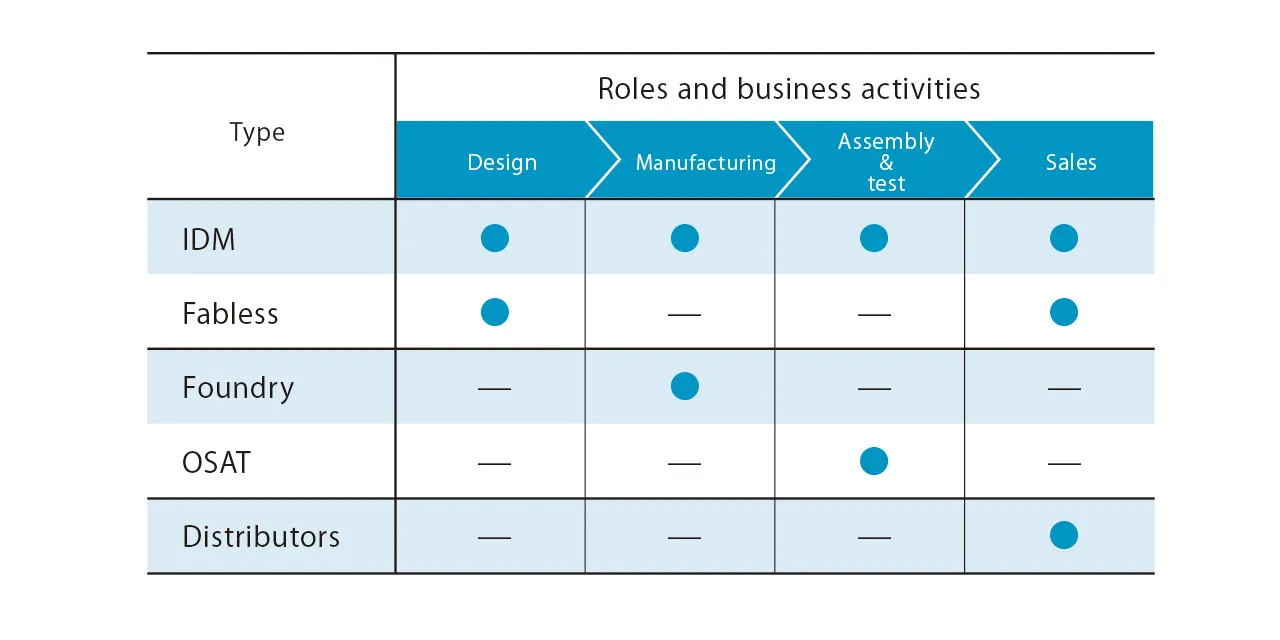

Two semiconductor business models: Integrated device manufacturer vs. horizontal specialization model

The semiconductor industry has evolved into two primary business models in response to technological and market change: the integrated device manufacturer (IDM) model of vertical integration and the horizontal specialization model.

IDM

In this model, a single firm handles all stages—from design and development to manufacturing, assembly, testing and sales. Until the 1990s, most major semiconductor companies adopted this model, leveraging massive capital investments and internal expertise to dominate the global industry. Its strengths include tight coordination between design and fabrication, proprietary technologies and stable supply. However, the high cost of equipment and R&D, coupled with the risk of unsold inventory, became significant drawbacks.

Horizontal specialization

By contrast, the horizontal model separates design from manufacturing. This approach has become mainstream. On the design side, Professor Mead of Caltech proposed dividing the increasingly complex process of large-scale integration (LSI) design into logical, circuit and layout layers—decoupling it from manufacturing. In the 1980s, this idea gave rise to fabless companies in the Silicon Valley. Initially, these firms outsourced manufacturing to IDM companies, which used excess capacity in their fabs. However, this created risks: proprietary design knowledge could leak, and production depended on each IDM's capacity.

On the manufacturing side, as circuit geometries shrank, capital expenditures skyrocketed—making failed chip sales financially devastating.

The birth of foundries and shifting industry power

In 1987, the world's first dedicated foundry firm was established in Taiwan. At the time, IDM companies were dominant, but this new foundry began to take on unused wafer fab capacity from U.S. fabless and IDM firms—and sharpened their own capabilities. For foundries, the advantage is clear: stable revenue from manufacturing on behalf of multiple clients enables reinvestment in technology and capacity. Fabless firms benefit from cost control and reduced IP leakage risk.

As foundries rose, fabless firms flourished—designing advanced chips without owning factories, relying on external foundry partners. This fabless–foundry partnership accelerated speed and efficiency, and by the 1990s, horizontal specialization became the industry standard.

Further, alongside foundries came Outsourced Semiconductor Assembly and Test (OSAT) firms specializing in packaging and testing. Today, fabless firms can outsource both fabrication and post-fabrication, eliminating the need for in-house fabs.

The strategic importance and influence of foundries

Foundries now serve as strategic cornerstones of the semiconductor industry and have rapidly grown in strategic importance. Driven by rising demand for advanced chips in AI, 5G, IoT, automotive and healthcare sectors—and an increasing number of fabless design firms—foundries offer cutting-edge process technology and large-scale production capacity. They are no longer mere manufacturing contractors but national-level players. Advanced chipmaking demands massive capital and R&D and only a few companies globally can build such capacity. As a result, foundries now hold global importance —and bear enormous influence over national economies and industrial security.

In response, countries like the U.S. enacted the CHIPS Act in 2022 to promote domestic fab capabilities. Europe is similarly inviting foundries to build facilities in its region—reflecting intensifying global competition for cutting-edge semiconductor manufacturing leadership.

Rapidus: Its role and path to innovation as a Japanese foundry

Founded in 2022, Rapidus aims to restore advanced semiconductor manufacturing in Japan. Leveraging IBM's 2nm gate-all-around (GAA) technology and collaborating with global R&D leaders such as imec in Belgium and Fraunhofer in Germany, Rapidus plans to start 2nm mass production by 2027.

In front-end processing, Rapidus uses GAA transistors to achieve both miniaturization and low power, targeting markets from high-performance AI data centers to ultra-efficient edge devices.

Unlike traditional batch processes, Rapidus uses a fully single-wafer process. By collecting big data during manufacturing and applying AI, it targets a 2–3× acceleration in cycle time—cutting ramp-up by around 40%, claiming one of the fastest production timelines in the world.

In back-end processing, Rapidus is developing proprietary chiplet integration technology to connect function-specific dies densely. Its vertically integrated model supports feedback from manufacturing into design—enabling cost efficiency and higher yield in a world of small-lot, diverse chip demand.

Summary: Foundries as the foundation of our digital society

Foundries rarely gain public attention, but they provide the backbone to our society and serve as vital infrastructure. From smartphones and cloud deployments to AI and vehicles, semiconductor fabrication is crucial and without foundries, none of it is possible. With the continued growth in 5G/6G, AI and IoT, semiconductor demand will surge further. Foundries, investing heavily in innovation and process scaling, will remain the invisible giants sustaining the global digital economy.

Through its domestic founding mission, Rapidus seeks to contribute to innovation, bolster economic security and support the future of our digital lives.

A circuit integrating many electronic components—transistors, resistors and capacitors—onto a single semiconductor chip.

- #Semiconductor

- #Front-End

- #Back-End

- #Design